Who is Bill Binch?

Bill Binch led revenue teams at highly successful B2B SaaS category creators, including Marketo and Pendo. Bill offers a unique perspective on how Chief Revenue Officers use metrics to inform their journey through real-life, experience and success at scaling high-growth companies. His insights expand even more due to his experience across several Battery Ventures portfolio companies.

Bill's use of metrics to lead revenue teams has evolved throughout his career, alongside the advancement of revenue technology. Sales has traditionally been the ultimate “metrics measured” function, but today's CRO has the ability for even greater insights into the "signals" or "leading indicators" that directly impact quota achievement and revenue growth performance.

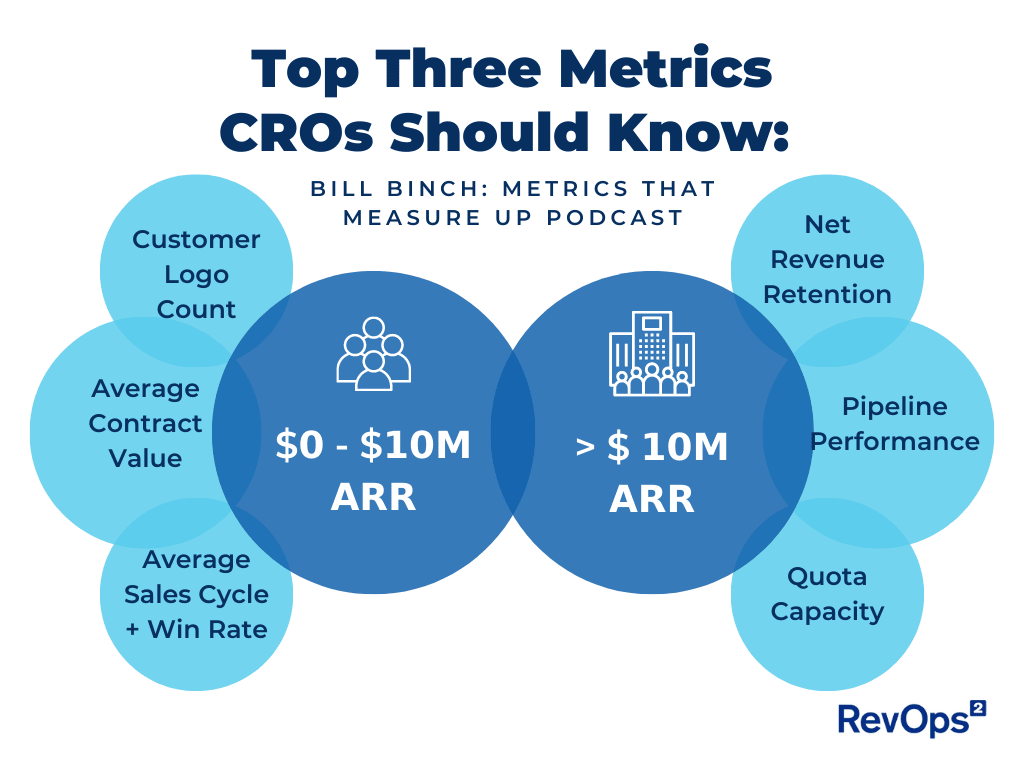

Top metrics CROs should know and use:

Today's Sales leaders are reviewing and analyzing pipeline trends daily, which includes the need to understand which sources are delivering the most, and the highest quality pipeline that converts into Closed-Won revenue. What metrics are most important for a CRO to use at each stage of a B2B SaaS company's growth? Here are the top three metrics that Bill Binch suggests CROs should use for companies with <$10M ARR and then >$10M ARR.

$𝟬 - $𝟭𝟬𝗠 𝗔𝗥𝗥:

Very early on, Customer Logo Count is a key metric - provides the sales team confidence and provides potential customers peer group validation

Average Contract Value growth highlights the value customers see in a solution

Average Sales Cycle & Win-Rate are strong signals that potential customers have a understood need by having budget allocated (shorter sales cycles), and over time win a greater percentage of deals against competition and/or reduce the number of lost opportunities due to “No Decision”

> $ 𝟭𝟬𝗠 𝗔𝗥𝗥

Pipeline performance including daily changes in pipeline value and increasing conversion rates from qualified lead to Closed-Won

Quota Capacity that factors in historical quota achievement rates, new hire ramp time to productivity and sales resource attrition rates

Net Revenue Retention (NRR) measures how much ARR a current customer delivers year over year including up-sells, cross-sells and organic user or usage expansion. Example: $50K ARR last year and $60K ARR this year = 120% NRR

The responsibilities of a CROs:

Bill defined the responsibilities of a CRO beyond closing new deals, which is the primary goal of a Vice President, Sales. He combined all of the responsibilities of a CRO into a single word, “REVENUE”. Bill breaks this concept into “three things with a dollar sign on it” including:

Customer Acquisition (New Revenue)

Customer Expansion (Growth Revenue)

Customer Retention (Renewal Revenue)

The "Intersection" of Marketing and Sales:

Bill firmly believes that Sales and Marketing should co-own the qualified pipeline goal. This approach goes beyond measuring success primarily on leads, Marketing Qualified Leads (MQL) or other top of funnel objectives that do not directly impact the pipeline. He says Marketing should be held accountable to the entire pipeline number, to avoid “grading their own homework” by setting and delivering their own goals such as downloads or leads. The "intersection" of Marketing and Sales is PIPELINE. As an operating partner at Battery Ventures, in board meetings, Bill far too often sees Marketing and Sales present separate data, metrics, dashboard and reports that have little to no alignment, direct correlation and definitely no causation to pipeline and revenue.

What are the "pipeline metrics" Bill thinks are most important? Bill likes the "Pipeline Coverage Ratio" which calculates how much qualified pipeline is required to achieve $X in revenue. Bill also introduced his pipeline "MOJO" dashboard which includes a dashboard that tracks daily pipeline movement - by opportunity, including:

Pipeline created

Pipeline lost

Pipeline expanded

Pipeline decreased

Pipeline pulled forward

Pipeline pushed back

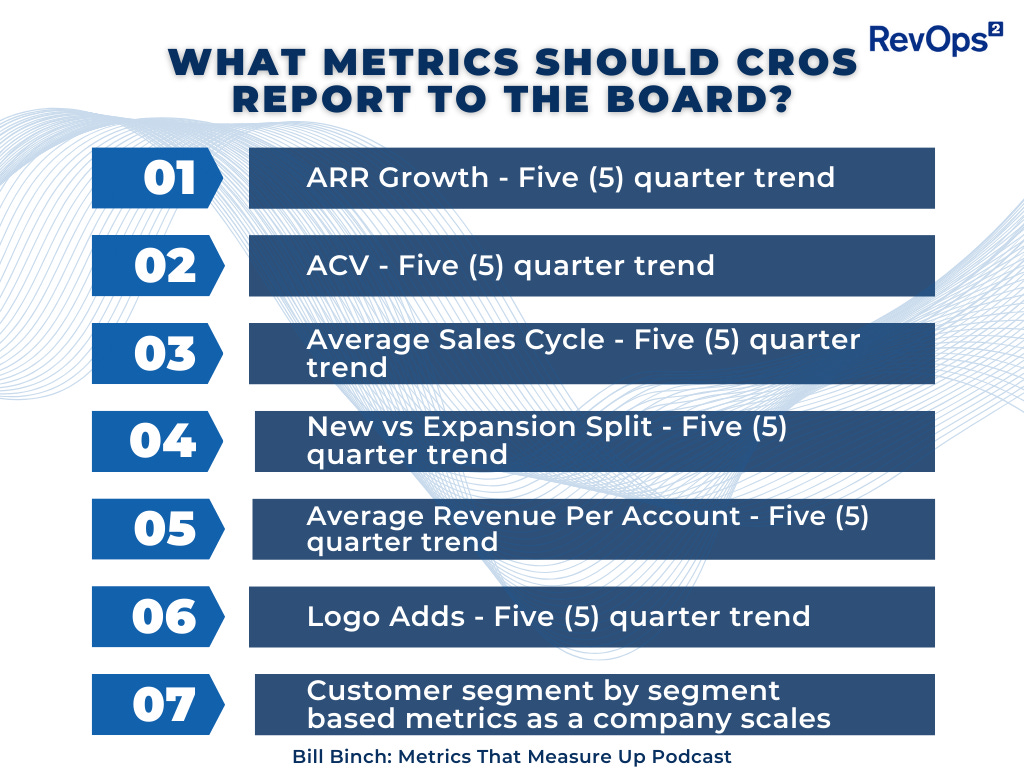

What performance measurements should CROs own and report to the board:

Bill shared that since the CRO should own all revenue inputs, including acquisition, retention, and expansion, he believes that early on the CRO should also be responsible for the Customer Success function. However, once a company scales to greater than $50M - $100M the role of the Chief Customer Officer should report directly to the CEO and not the CRO.

What was Bill’s perspective on the CRO owning revenue efficiency metrics, such as CAC Payback Period and Customer Lifetime Value? Bill believes the CRO should be aware of how the revenue performance metrics they own impact company level metrics that the CFO should own, including CAC Payback Period, Customer Lifetime Value, and Rule of 40.

What are the core metrics the CRO should report to the board? They include:

ARR Growth - Five (5) quarter trend

ACV - Five (5) quarter trend

Average Sales Cycle - Five (5) quarter trend

New vs expansion split - Five (5) quarter trend

Average Revenue Per Account -Five (5) quarter trend

Logo adds - Five (5) quarter trend

Customer segment by segment based metrics as a company scales

Capturing and presenting the five (5) quarter trend was an important point to Bill, as it allows for a year over year insights, which may include seasonality trends that are present in some businesses.

Learn more:

You can listen to more of Bill Binch’s experience as the CRO that led growth at two incredibly successful and market creating SaaS companies on the Metrics that Measure Up Podcast. Make sure you are subscribed here to receive the Metrics that Measure Up weekly newsletter every Saturday morning at 7 AM ET.

Great article Ray - Binch is one of the GOATs

Loved the supporting imagery to drive home the key points on this one